By Thomas H. Ruggie

Forbes Councils Member

June 30, 2022

Alternative investments that provide an “alternative” to the more traditional investment universe of stocks and bonds are becoming less “alternative” as greater numbers of ultrahigh net worth individuals and similarly qualified investors seek potentially greater returns in ways that don’t automatically necessitate greater risk. A recent EY report found that 81% of ultrahigh net worth investors surveyed hold alternative investments in their portfolios.

For the appropriate investor, alternatives offer a range of opportunities that can support specific investment strategies and objectives, including the tailoring of risk management profiles, balancing risk against return based on risk tolerances and meeting specific investment goals (such as the preservation of capital during periods of market volatility). While all investments come with some degree of risk, alternatives offer the potential for significant upside when compared with more traditional asset classes.

There is another vantage point from which to view alternative investments: the perspective of ultrahigh net worth individuals and families and their personal aspirations to impact the world around them. A recent report by KKR found that a significant and growing amount of high net worth families are “focused on social change, using their assets to promote education equity, environmental progress, disease cures, and medical research, alongside other public objectives.”

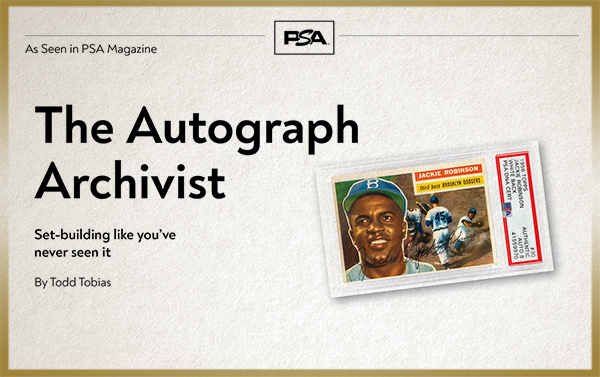

Let me use myself as an example to illustrate the intersection between alternative investments and the personal passions of an investor. For most of my life, I’ve collected sports memorabilia. I started my collection not as an investor, but as someone who loved baseball. The fact that it has grown into a valuable alternative investment has been, over time, a factor of both art and science.

A previous article I published on Forbes.com highlights what a collector/investor needs to consider to protect family members when they stand to inherit this kind of alternative investment, especially when they have no passion for it or understanding of its actual worth.

The KKR report speaks to the impact ultrahigh net worth individuals and families may want to have through their alternative investment strategies. Investment opportunities that speak to innovation and seek to solve unanswered needs can be compelling—both as investments and as ways to satisfy the personal visions of the investor.

A specific investment can take on multiple dimensions that must be closely evaluated for appropriateness across a range of criteria that includes considerations other than just risk and return. Investors may want to evaluate their relationship with trusted advisors in terms of vision, mission and values alongside more traditional performance metrics. Qualitative and quantitative data points can be important. The commitment and passion of the advisor, for example—may be an interesting, if not valuable, point of reference for individuals or families who are investing.

As with most things, alternatives are subject to a range of pros and cons and may not be appropriate investments for many reasons. Transparency into the investments and the liquidity of those investments over time are just two areas where investors should focus attention.

Ironically, while many investors engage with an advisor to take on the work and worry related to investment management, ultrahigh net worth investors often find themselves more involved than they would be with traditional investments. This is neither good nor bad from the perspective of the investor or advisor but can be another consideration in helping the investor determine the appropriateness of the opportunity, and of alternatives in general.

I don’t see much discussion around the pros and cons for advisors. And while some investors may question why they should care about such things, I believe how an advisor navigates the pros and cons related to alternatives can impact the investor. For example, how is the advisor gaining access to these alternative investments? What people, systems and processes do they have in place internally and externally through third-party partners and providers?

Considerations such as access can impact the availability and viability of opportunities. How is an opportunity evaluated? Research and vetting will be a significant factor here. How is an investment opportunity made? If with a co-investment, what will influence the degree to which there is transparency in reporting and liquidity? Regarding liquidity, the idea of “patient capital” comes to mind. Is there a clear understanding of how long dollars invested in alternatives will be unavailable to take out of those investments? This can vary widely.

Diversification is an important consideration for alternative opportunities, too. Some advisors, for example, create one bucket to meet their ultrahigh net worth investor’s near-term and ongoing liability and liquidity needs. Then a second bucket to position the client in more traditional asset classes, and a long-term bucket to give the investor access to investment opportunities that tend to have higher returns but possibly higher risk.

In this last bucket, the need for diversification across various alternative investments can work to manage risk further. Types of diversification include diversification by sector or industry, the number of opportunities an investor is invested in, the source of the investment (where it originated) and vintages (or the year the first significant investment was made).

For the appropriate qualified investor, at the appropriate time, alternatives can offer a range of opportunities that can support specific investment strategies and objectives. And while these alternative investments can yield significantly higher returns than traditional investments, there is always the presence of risk and potential loss of the capital invested.

Before investors commit to investing in alternatives, they should have a clear understanding of their overall financial situation, the amount of money available for investing, their need for liquidity and tolerance for risk.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms.